If you file the second quarter Kind 720 solely to report the PCOR charge, no filing is required in different quarters until you have to report other charges or taxes. In apply, all the time separate your federal excise tax compliance from state compliance. Kind 720 goes to the IRS and covers federal law necessities. For state excise obligations, you’ll deal with state businesses.

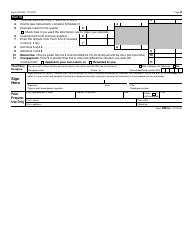

- The internet tax legal responsibility for a semimonthly period is the total legal responsibility for the period minus any claims allowed on Schedule C for the period.

- The IRS supplies detailed instructions on which industries and actions are topic to excise taxes.

- The blender claimant must be registered by the IRS and should enter their registration quantity on line 14d and enter the applicable CRN.

- Tickmark, Inc. and its affiliates don’t provide legal, tax or accounting recommendation.

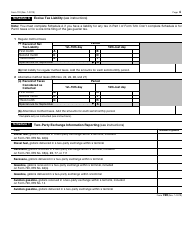

You don’t should pay if line 10 is beneath $1.00. Use Form 6627 to figure the liability for this tax. Enter the amount from Type 6627, Part IV, line 4, column (d), on the road for IRS No. 20. Attach Form 6627 to the Kind 720 that is due July 31 of every yr. See section 4043 for extra data on the surtax. See Schedule T. Two-Party Trade Information Reporting, later, if applicable.

Use this type to make changes to liability reported on Forms 720 you may have filed for previous quarters. Do not use Type 720-X to make adjustments to claims made on Schedule C (Form 720), apart from the section 4051(d) tire credit and section 6426 credits. Paper excise tax forms are taking longer to process. This contains Types 720, 2290, 8849, and faxed requests for expedited copies of Kind 2290 Schedule 1. IRS Type 720, Quarterly Federal Excise Tax Return , is a fiscal doc used by taxpayers to stipulate the excise taxes charged on sure companies and goods.

At the tip of each quarter, you’ve till the tip of the following month to file and pay your excise taxes. Though we can’t reply individually to every comment obtained, we do respect your suggestions and can think about your feedback and recommendations as we revise our tax forms, instructions, and publications. Do not ship tax questions, tax returns, or payments to the above tackle. The web tax legal responsibility for a semimonthly period is the entire legal responsibility for the interval minus any claims allowed on Schedule C for the period. Web tax legal responsibility for a semimonthly period may be figured by dividing the web tax liability for the month by 2, offered this technique of computation is used for all semimonthly durations within the calendar quarter. Patient-centered outcomes analysis (PCOR) fee (IRS No. 133).

Exported Taxable Fuel

If a deposit is due on a day that isn’t a business day or that is a authorized vacation, see When To Make Deposits , later. The time period “legal holiday” means any legal holiday within the District of Columbia. If you don’t deposit as required and as a substitute pay the taxes with Kind 720, you might be topic to a penalty. You may be required to file Type 720-X, Amended Quarterly Federal Excise Tax Return, now that the TD is printed to report revisions to your initially reported section 5000D liability. The tax on arrow shafts is elevated to $0.63 per arrow shaft.

You are obliged to submit Kind 720 to tax authorities if your business sells goods or offers providers while incurring excise taxes – taxes imposed by the federal government on certain https://www.intuit-payroll.org/ items and services. The person that produced and offered or used a certified combination (a mixture of SAF and kerosene) is the one particular person eligible to make this claim. The credit score relies on the gallons of SAF within the qualified mixture.

High File Kind 720 annually to report and pay the fee on the second quarter Type 720 no later than July 31 of the calendar year immediately following the last day of the coverage year or plan yr to which the fee applies. Form 720 spans a variety of industries and tax varieties. The form is actually a catch-all for federal excise taxes that aren’t reported on specialised returns. Submitting Type 720 is essential for businesses topic to federal excise taxes.

What Is A Federal Excise Tax?

For submitting Form 720, having an Employer Identification Quantity (EIN) is mandatory. This part of the article explains the function of the EIN within the submitting course of and the way companies can get hold of one if they don’t have already got it. This is particularly necessary for new or small businesses unfamiliar with tax filing necessities. A. Taxpayers shall be required to submit their electronic Excise Tax types by way of an permitted transmitter/software developer.

Enter the amount of premiums paid through the quarter on insurance policies issued by international insurers. Multiply the premiums paid by the charges listed on Kind 720 and enter the entire for the three types of insurance on the line for IRS No. 30. Various gas is any liquid aside from gas oil, gasoline oil, or any product taxable underneath section 4081. You are responsible for tax on alternative fuel delivered into the fuel supply tank of a motorized vehicle or motorboat, or on sure bulk sales.

Generally, issuers of specified medical insurance insurance policies must use one of the following 4 different strategies to determine the average variety of lives coated underneath a coverage for the policy 12 months. An settlement, documented by the written program agreements, beneath which the fractional program plane can be found, on an as-needed basis with out crew, to each fractional owner. You are answerable for the tax on the fuels listed beneath when they’re delivered into the gasoline provide tank of a motor vehicle or motorboat.

To make an final vendor declare on traces 7–11, you should be registered. Enter your registration quantity, including the prefix (for prefixes, see the instructions for Form 637, Application for Registration), on the relevant line in your declare. If you aren’t registered, use Kind 637 to use for a registration quantity. The final purchaser of the taxed various fuel is the one individual eligible to make this declare. For traces 5a and 5b, the last word purchaser of kerosene utilized in industrial aviation (other than foreign trade) is eligible to make this declare.